Quicken Home and Business is a powerful software for manage your finance and money at one place. You can easily organize your financial issues. Daily you are use multiple accounting websites and also create accounts for paying bills and other payments.

As a result, many PC owners who consider buying a Mac but rely upon Quicken resist switching. Or, they resort to work-arounds, such as installing Windows on their new Macs or keeping around an old PC—solely to run the more robust Windows version of Quicken. This week, Intuit (INTU) hopes to alleviate this situation with an all-new $60 version called Quicken Essentials for Mac, or QEM for short. The company describes QEM as the first version of Quicken developed specifically to run on a Mac, as opposed to being copied from a Windows product. It also says the product was influenced by a Mac-savvy team from Mint, a Web-based personal-finance service Intuit acquired late last year. I’ve been testing Quicken Essentials for Mac, and have seriously mixed feelings about it. In general, it worked well and kept its promises, and it largely solves the crucial data-conversion problem.

Unlike its predecessor, Quicken for Mac 2007, it looks and feels like a modern Mac program. It also can download transactions from over 12,000 banks, brokerages and other financial institutions—about triple the number supported by the prior Mac version and double the number supported by the base version of Quicken for Windows. However, this program is still no match for the Windows version in the breadth and depth of its features, and is even a step backward in some features from the old 2007 Mac version. Google mail setting for mac imapmail. It is really a stripped-down version of Quicken, for basic tracking and managing of your finances.

It isn’t likely to satisfy hard-core family financial planners, especially those who like to keep an eagle eye on investments or create detailed budgets and reports. Most important, Quicken Essentials doesn’t display, or even allow you to enter or edit, individual transactions in investment accounts.

It only shows a snapshot of the current status and value of the overall investment account and of the securities or funds it holds. It also lacks a bill-paying feature. And it can’t export your data to Intuit’s popular TurboTax program. Even the much-maligned older Mac version could do these three things.

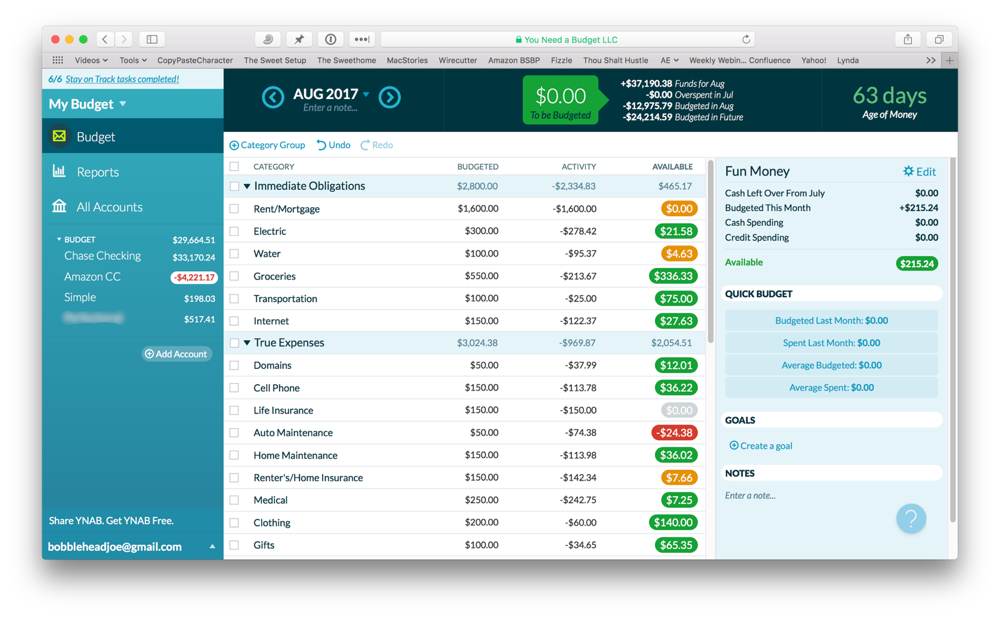

While QEM is easy to use and has colorful, understandable charts and graphs that show your financial situation, its budget and reporting capabilities are rudimentary, and it has no planning features for helping you reduce debt or save for retirement. The new team from Mint, now in charge of Intuit’s Personal Finance group, concedes that QEM lacks some important features, but says it hopes to add detailed investment-tracking and bill-paying to a future edition. The company claims the new QEM will satisfy the needs of users who aren’t deeply into investment management or planning, or who are new to personal-finance software.

For my tests, I entered my own various bank, credit-card, retirement and brokerage accounts, and the program was able to automatically download transactions for my checking and credit-card accounts, and snapshot views of my investment accounts, in most cases. In a few instances, I had to go through an intermediary step of downloading a file from a bank or brokerage Web site, and then importing it into QEM. Quicken Essentials can update each account separately, or all your accounts at once. But I couldn’t find any way to schedule automatic downloads of data. The company boasts that one of its big advantages is that it automatically categorizes transactions you download.