Quicken 2017 has far fewer features than Quicken 2007. It offers similar functionality to Mint (also owned by Intuit) and Personal Capital but lacks the advanced reporting tools, planning calculators, investment tracking, and home finance utilities — emergency records organizer, home inventory, etc. — found in Quicken 2007. Download Quicken Starter Edition 2014, Quicken Deluxe 2014, Quicken Premier 2014, Quicken Home & Business 2014, Quicken Rental Property Manager 2014, Quicken Essentials for MAC 2014 or Quicken.

One of the most popular personal finance software applications on the market today is. They’ve been around for decades, and over the years I’ve used Quicken faithfully — even after getting a Mac.

When I first went to college more than 15 years ago, my parents gave me a computer with a version of Quicken, and told me to use it to keep track of my finances. Quicken is pretty much the gold standard in personal finance applications. Quicken can manage every aspect of your finances: bill paying, reconciliation, budgeting, goal setting, investment performance tracking, retirement planning, asset allocation, debt reduction, categorize your income and spending, and much more. You’ve made the resolution you want to get better with your finances, and decided you want to use Quicken. With the amount of features Quicken has it can be overwhelming where to begin. To get started with using Quicken, follow this detailed step-by-step tutorial: Step 1: Purchase Quicken We recommend buying from Amazon.

Amazon offers immediate software download or CDROM sent via mail. There are multiple versions of Quicken available. If you are confused on which version to buy we recommend Quicken Premier because of the investing options and has the most popular features available. Amazon frequently changes their prices. The prices listed below are updated hourly. Version Retail Price Sale Price Discount Link Quicken Starter for Windows $39.99 $39.99 0% Quicken Deluxe for Windows $79.99 $64.99 19% Quicken Premier for Windows $54.99 $45.00 18% Quicken Home & Business for Windows $104.99 $84.99 19% Quicken for Mac $79.99 $64.99 19% Step 2: Create an Intuit ID to Connect After buying and downloading Quicken, you’ll be asked if you want to use your Intuit ID. If you already use an Intuit product (like Mint.com, QuickBooks, TurboTax, or an older version of Quicken), check to see if you already have an Intuit ID.

Canon pixma mx920 driver for mac. If you don’t have an Intuit ID, you can choose to create one. It’s easy, and starts with using your email and setting up a password. If you want to use Quicken Connected Services to better sync everything, you’ll need an Intuit ID (so create one if you don’t have one already). Connecting everything this way can be useful if you use other Quicken products like Investing.Quicken.com, TurboTax, and QuickBooks, and you want all your info connected. If you are wanting to sync your financial information on your mobile device, then you will need to create an Intuit ID. However, you don’t have to use Quicken Connected Services if you don’t want to.

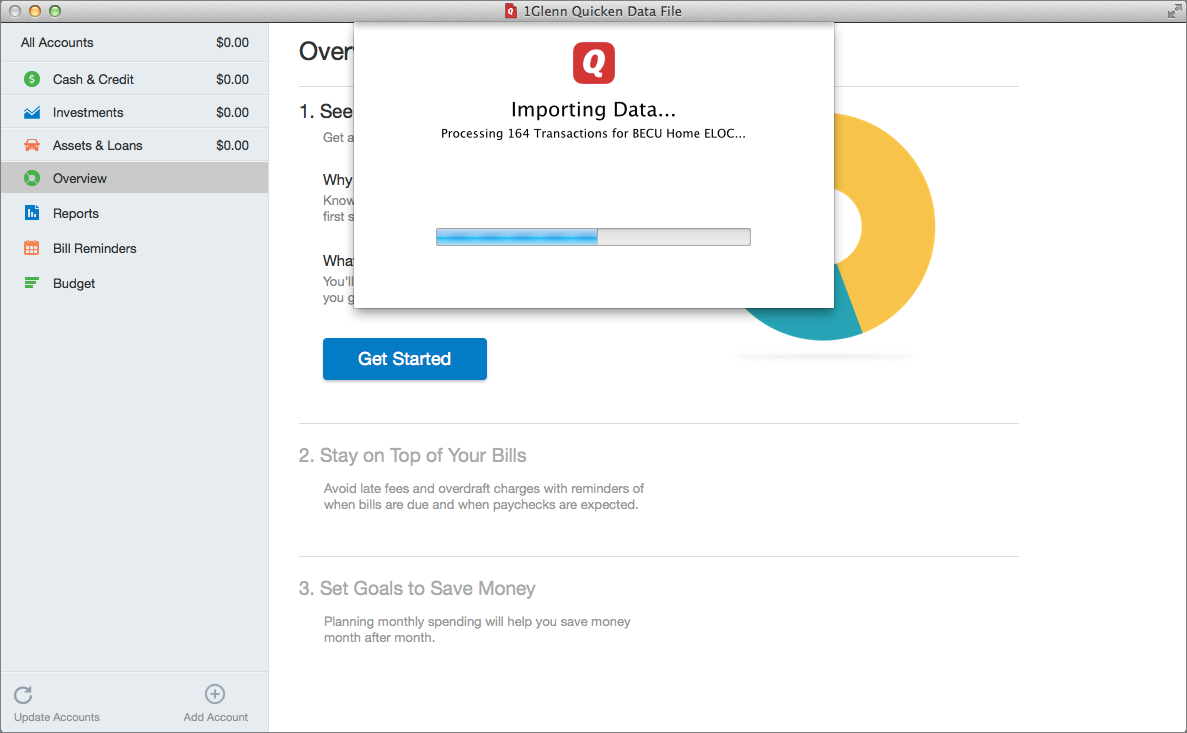

You have the option to select “Use Quicken without connecting.” Once you’ve decided whether or not to use an Intuit ID, and Quicken Connected Services, you can then register your copy of Quicken. Registering makes it easier to recover the software if you need to, without buying another copy, since you’ll have a record of the version you’re using. Step 3: Create and Sync Your Accounts In the next step, you’ll be prompted to set up your first account. Quicken first takes to you to the “Home” tab, which is where you’ll get an overview of your finances.

The Home tab allows you quick access to your spending habits, upcoming bills, and even your budget. The first step you see highlighted is a “See Where Your Money Goes.” Click on the blue “Get Started” button in this section, and you can begin adding accounts. This is where you decide whether you want to add your information manually, or if you want to connect your bank accounts electronically.