We wish to find out covariance in Excel, that is, to determine if there is any relation between the two. The relationship between the values in columns C and D can be calculated using the formula =COVARIANCE.P(C5:C16,D5:D16).

What is the COVARIANCE.S Function? The COVARIANCE.S function is categorized under Functions The COVARIANCE.S function is categorized under Statistical functions. It will calculate the sample covariance for two sets of values provided by a user. As a financial analyst, the covariance function is very useful when we want to find the extent to which two assets move in tandem, i.e., if we wish to. It will calculate the sample covariance for two sets of values provided by a user.

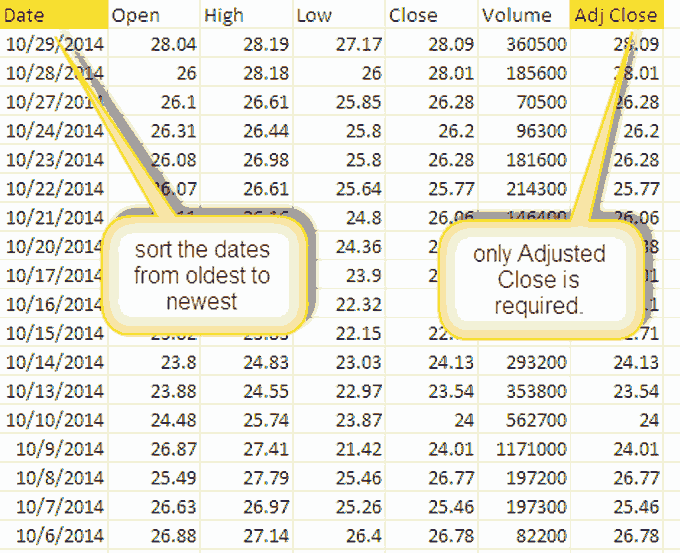

As a FMVA™ Certification The Financial Modeling & Valueation Analyst (FMVA)™ accreditation is a global standard for financial analysts that covers finance, accounting, financial modeling, valuation, budgeting, forecasting, presentations, and strategy., the COVARIANCE.S function is very useful when we want to find the extent to which two assets move in tandem, i.e. If we wish to find the relationship between the movement of Bitcoin Bitcoin is the forerunner of the cryptocurrency market. Operating on blockchain technology, Bitcoin is set to disrupt the currency market. Invented in 2008, Bitcoin is now the largest cryptocurrency by market share. As of June 2017, BTC has a market of nearly $40 billion. Vis-a-vis Ethereum Ethereum is one of the growing cryptocurrencies to contend against Bitcoin. With the rise of Bitcoin (BTC), the cryptocurrency market has been validated.

Because of this, new cryptocurrencies or coins have tried to penetrate the market and grab a slice of the pie. Ethereum is Bitcoin's strongest competitor. If we get a positive covariance, it means they move together and a negative covariance means they move in opposite directions. The function is quite useful when our investment money is limited and we are risk-averse.

One example is when we’ve shortlisted three stocks but can afford to invest in two stocks only. The covariance between the three stocks is as follows: • Stock M and Stock N = –100 • Stock M and Stock P = 100 • Stock N and Stock P = 0 If we are solely looking at the returns, we will choose stocks M and P, as they show the highest potential returns. However, they also show the highest potential loss, too. If we are risk-averse, we would choose stocks M and N to diversify the amount of risk away. Covarience Formula =COVARIANCE.S(array1, array2) The function uses the following arguments: • Array1 (required argument) – It is the first array of numeric values. • Array2 (required argument) – It is the second array of numeric values. The arguments can be either numbers or names, arrays, or references that contain numbers.

How to use COVARIANCE.S Function in Excel? The COVARIANCE function was introduced in Excel 2010 and is available in all subsequent Excel versions.

Free accounting software for Mac ZipBooks is the best free accounting software for Mac. Sign up for a free account and gain access to our professional design, simple invoicing, and time tracking capabilities. Software for mac computers.

To understand the uses of this function, let us consider an example: Covariance Example Suppose we are given data about the weekly returns of Stock A and percentage of change in the market index (NASDAQ): Let’s use the function to understand if there is any covariance between the stock returns and NASDAQ returns. We get the result below: The result indicates that there exists a positive correlation between the two. Few notes about the COVARIANCE.S Function • #N/A error – It occurs if the given arrays, that is array 1 and array 2, are different in • #VALUE! Error – Occurs if either of the given arrays is empty. Error – Occurs if any of the array, that is either array 1 or array 2, is empty or contains only one data point. • If an array or reference argument contains text, logical values, or empty cells, the values are ignored; however, cells with the value zero are included.