How We Chose the Best Personal Finance Software Security If we’re handing over bank accounts, credit card numbers, and the rest of our financial information to a company, we need to be sure it’s taking strict security measures to keep that intel protected. So we scrutinized privacy policies and compared security claims. First, we cut any finance app without an “https” domain name.

Is the free trial fully functional without limitations? Yes, the trial version is fully functional, and you can add an unlimited number of accounts, tranactions, reminders, and so on. It allows you to fully test the software before you decide to buy.

The software comes with additional features like clock radio wake up which allows you to wake up to the internet radio station. Voice recording software free for mac.

That’s the secure version of http — it uses encryption to prevent any third-party interception while you’re accessing the web. This is especially important for (and even more so when you’re logging into your bank). Then, we dug into the fine print. All of our top picks use 128- or 256-bit encryption and TLS 1.2 for transmissions — the most up-to-date protections on the web. These ensure that your data can’t be hacked or stolen while it’s in transit. Account Xpress, AceMoney, Budget Express, Home Bookkeeping, Monefy, Moneydance, Moneyline, Pocket Expense, RichOrPoor, Spending Tracker, SplashMoney Multi-factor authentication We also gave preference to personal finance apps that use multi-factor authentication. That includes any step beyond just entering a username and password, like receiving a secret code through text or email.

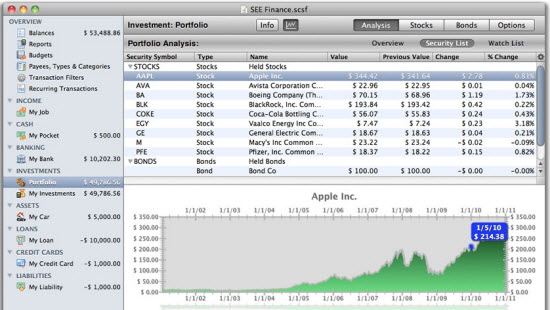

Confirming your identity through another device or channel ensures that you’re really you, and not some hacker who got ahold of the account info. Our top picks all require text- or call-based verification both when you set up your account and start using it on a new device. Access on mobile and desktop We made sure that all of our top picks offer mobile apps for both iPhone and Android, so you can check in and manage your finances on the fly — say goodbye to anxious mental math before picking up that next round of drinks. We also cut finance apps that only operate on mobile, without the option to use a desktop or web app. Mobile accounting is super convenient, sure, but a computer affords the space to see all your information laid out on one screen. This makes it easier to multitask — like keeping an eye on your debts and spending trends while you allocate funds to a budget.

Dollarbird, Goodbudget, GnuCash, Handwallet, Fortora Fresh Finance, Money Lover Customer support It’s likely that at some point down the road you’ll have questions: Why won’t my retirement account sync to my software? How do I set a long-term savings goal? Something looks funny; what’s going on with these numbers? Many of these can be answered through tutorials and FAQs, but finances are complex and really personal; sometimes there’s no substitute for an actual human helping you out.

So we called, messaged, and emailed customer support to find the most reliably helpful software companies out there. The best software should offer personalized feedback in case you’re struggling with an issue that’s not covered. Mobilis Personal Finances, Wallet (BudgetBakers) Ease of use The only thing left to do was to get up close and personal with our own finances. We set up accounts with our five front-runners, downloaded every app, and then got to work hooking up our bank accounts, tinkering with settings, tracking our finances, and building budgets.

We logged in every day for a month, checking to make sure transactions were imported properly, monitoring our spending trends, and seeing whether they helped us stick to our budgets with prompts and warnings. Overall, we were pleased with our top contenders.